07 Feb 2023 Job Market Analysis: Another Record-Breaking Year

If you follow us via LinkedIn, you’ll know that we track and analyse the health and safety job market monthly. We collect data from Australia’s most popular job boards, SEEK and LinkedIn. We then cross-check this data against reports from ABS, SEEK and other industry specialists. And we triple-cleanse the data. Unlike other reports, our data is accurate as we only track jobs belonging to the health and safety job family.

Now it’s time to share the 2023 full-year data with you!

The data reveal (drum roll please!)

Despite constant warnings in 2022 indicating job vacancies would soften in 2023 due to the state of the Australian economy, Australia’s unemployment remained at levels in 2023 comparable to 2022 at 3.8%, reflecting an increasingly tight labour market, high job vacancies and ongoing labour shortages despite continued interest rate rises (source ABS).

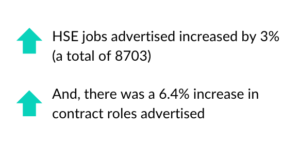

HSE job vacancies in 2023 defied negative predictions and continued to outperform other professions. Just when we thought it would be impossible to beat 2022’s record of 8,453 jobs advertised, the HSE market did just that!

This performance is remarkable given the uncertainty in the economy and SEEK reporting that advertised roles on their platform decreased nationally in 2023 (although they also referenced roles advertised are still above average compared to pre-pandemic levels).

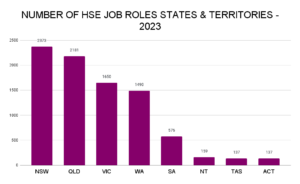

Where were the jobs?

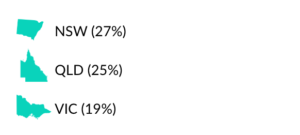

The majority of health and safety jobs were advertised in

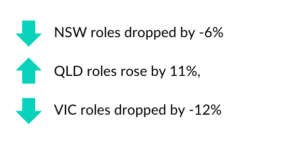

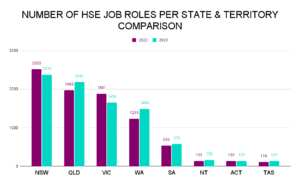

Compared to 2022,

Key Takeaway; Queensland’s growth in health and safety jobs compared to NSW and VIC could be predominantly due to a combination of projects related to transport infrastructure, wind and solar, social housing, the resources boom and venue infrastructure for the 2032 Olympics – all requiring more health and safety professionals (source).

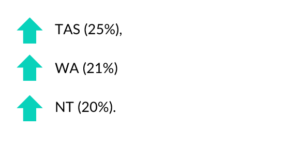

However, the most significant growth in health and safety jobs advertised from 2022 to 2023 was seen in;

Key Takeaway; Government jobs led the way in Tasmania, whilst mining dominated WA and construction dominated in the Northern Territory.

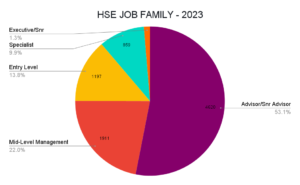

And at What Level?

Unsurprisingly, in 2023, the majority of vacancies advertised were allocated to Advisor/Senior Advisor/Business Partner/Consultant level (53% of vacancies).

Following behind were vacancies targeting mid-level managers (22%) and Entry Level professionals (14%).

Specialist roles (e.g. workers compensation, injury management, systems, occupational hygiene etc) were steady for their market portion.

Executive & Senior Management vacancies were the least advertised (1.4%) – but they always are as there are fewer opportunities.

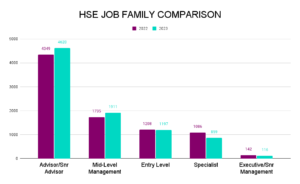

Compared to 2022, Advisor/Snr Advisor/Business Partner/Consultant and Mid-Level Management vacancies were the only vacancies to grow (6% and 10% respectively). This growth indicates a blend of replacement and newly created roles – the latter, particularly prevalent in the richer resources-fueled States.

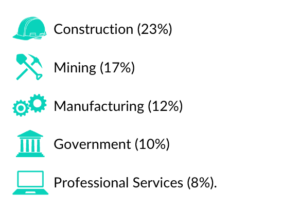

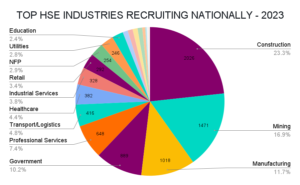

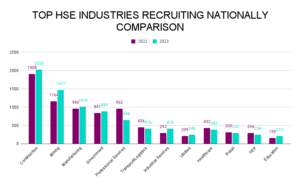

Construction continued its dominance

Just like 2022, construction continued to dominate as the number one employer of health and safety professionals across most States, except WA, where mining led and ACT & TAS, where Government led.

The breakdown went like this;

Compared to 2022, Industrial Services (43%), Education (34%) and Mining (26%) saw the largest increases (but we note that whilst Education experienced growth, they advertised the least number of vacancies overall).

2023—Now, That’s a Wrap!

Reflecting on 2023, it was a year marked by notable trends in the health and safety job market, but mirroring some of the patterns observed in 2022. The significant number of health and safety job advertisements resulted in a supply and demand imbalance, particularly at the junior-mid level.

Key observations from the year include:

- Extended Recruitment Processes: Attraction processes for HSE positions took longer than usual and often surpassed set recruitment budgets with additional costs such as advertising expenses, recruitment agency fees, or wages for contractors filling temporary vacancies.

- Proactive Recruitment Strategies: Forward-thinking organisations responded promptly by streamlining their recruitment processes, providing hybrid work options, and ensuring that offered salaries remained competitive in the market.

- Candidate-Led Market Dynamics: Candidate confidence remained high in 2023, influencing a candidate-centric job market. Prospective employees were discerning and high on their agenda was flexible work arrangements as a crucial factor for considering a job change.

- Salary Negotiations with Perks: In some instances, job candidates expressed a willingness to maintain their existing salary when moving to a new employer, provided additional benefits like extended leave or a higher superannuation percentages were offered.

- Premium Salaries for High-Risk Work: Industries immersed in high-risk work, especially in resource-rich regions like Queensland and Western Australia, offered substantial salaries to attract candidates.

- Slow Movement at Senior/Executive Levels: Similar to the trends observed in 2022, the senior and executive levels of the health and safety market experienced a slower pace of movement, with fewer job candidates seeking to leave their senior roles.

- Adjustments in Executive Roles: Not all executive roles were consistently replaced at the same level if they did come to the market. Some positions experienced title changes or structural adjustments, reflecting financial constraints in certain sectors.

- Redundancies Impacting Leadership Roles: Notably, redundancies were prevalent in a sprinkling of organisations within manufacturing, retail, and professional services, leading to the premature entry of some leaders into the job market.

Overall, it was a dynamic 2023 HSE job market influenced by economic conditions, candidate preferences, and organisational responses to market shifts.

What Can We Expect in 2024?

The volume of advertised HSE jobs in January 2024 is greater when compared to January 2023, which is a great sign so early in the year.

With Commonwealth Bank anticipating a 75 basis points reduction in the cash rate by the Reserve Bank of Australia in the second half of 2024, commencing in September, this could enhance confidence in spending and investment within Australia, potentially leading to increased job creation in the Health, Safety, and Environment (HSE) sector.

As outlined in the Department of Employment, Skills, Small and Family Business’ Economic Outlook Report 2024, several industries that employ a significant number of health and safety professionals could see an increase in total employment – another positive for the profession.

Healthcare and Social Assistance have been the primary providers of new jobs in the Australian labour market since the 1990s. This growth is supported by the continued demand from the National Disability Insurance Scheme and Australia’s aging population. Large hospital investments and increasing demand for childcare and home-based care services also contribute to this strong projected growth.

The second largest contribution is projected to come from Professional, Scientific and Technical Services, reflected by ongoing strength in demand for the services of qualified and highly educated workers throughout the economy.

Employment in the Education and Training industry is projected to increase, supported by increases in the school-aged population, continued strength in the international education sector and growing demand for adult and community education.

Construction is anticipated to remain a steady industry employer.

Final Word

Whilst predicting the HSE job market so early in the year is tricky, conversations with our CEO and HSE executive networks provides us with confidence that there will still be great roles for great candidates, but the pendulum may shift ever so slightly back to employers.

We estimate that there’s likely to be a measured influx of HSE talent hitting the job market due to the pending wind-down of large-scale infrastructure projects (particularly in Victoria & NSW), timely organisational restructuring and less candidate risk aversion regarding changing jobs. However, supply and demand issues may still impact some sectors when trying to attract HSE candidates at the junior-mid level.

Our discussions with our HSE executive network reveal that many are ready to take on a new role in 2024 – this could see the senior end of the market opening up and roles being hotly contested with more candidates on shortlists than in the previous few years. However, with over 60 countries, including the UK and US set to go to the polls in 2024, organisations with global parent companies may find hiring slows down.

We’ll continue to monitor the market and report back on our findings and trends throughout 2024, but we’d love to hear from you if you are keen to explore your next HSE role in 2024 or recruit great talent into your team.

Looking for your HSE unicorn or for your next role?

For more HSE recruitment tips:

- Follow HOK Talent Solutions on LinkedIn

- How Your CV Can Land You The Top HSE Job!

- The New Paradigm: Shifting from ‘Culture Fit’ to ‘Culture Add’ Hiring

Sources

Department of Employment, Skills, Small and Family Business’ Economic Outlook Report 2024

No Comments