03 Mar 2024 HSE Job Market Analysis: What a recap!

If you follow us on LinkedIn, you’ll know we regularly track and analyse the health and safety job market. As part of this process, we use data from Australia’s most popular job boards, SEEK and LinkedIn. We then cross-check this data against reports from ABS, SEEK, and other industry specialists. Finally, we triple-cleanse the data.

Unlike other reports, our data is accurate, as we only track jobs belonging to the health and safety job family.

Now it’s time to share the 2024 full-year data with you!

The data reveal (drum roll please!)

According to SEEK senior economists, 2024 saw a moderate decline in job ad volume, which continued in December, with job ads falling 3.0%.

Ad volumes began the year from an elevated base in January, but the market remained broadly balanced despite the downward trend. Applications per job ad remained very high, highlighting strong competition for open roles.

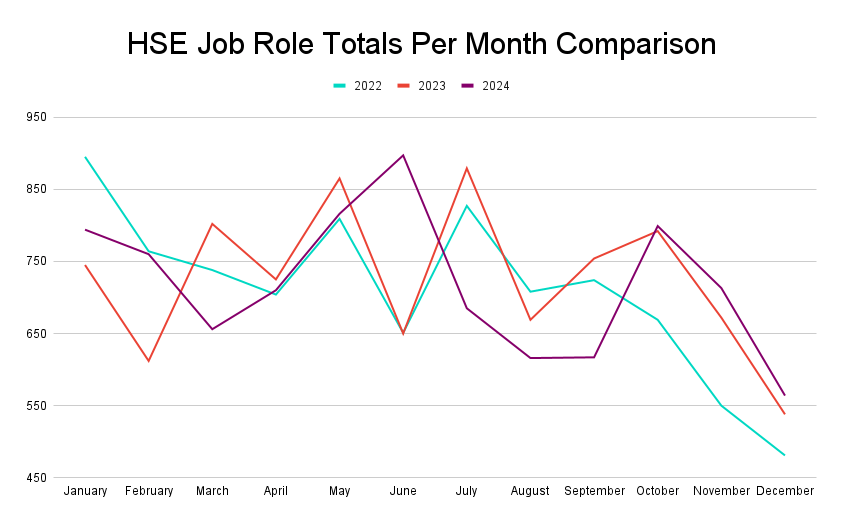

Our data followed a similar trend, broadly balanced with HSE job ads hitting all-time highs mid-year.

Despite the reduced job ad volume on SEEK, according to the ABS, unemployment was still low (starting at 4.1% in January and finishing at 4% in December).

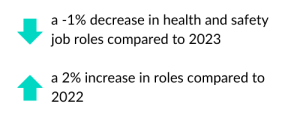

Looking at our data, there were a total of 8,627 roles advertised in 2024.

- Senior-level roles saw a 77% increase compared to 2023

- Systems specialist roles saw a 22% increase compared to 2023

This performance is remarkable given the uncertainty in the economy and SEEK reporting that advertised roles on their platform decreased nationally in 2024. HSE certainly remained strong!

Unpacking the 2024 Health & Safety Job Trends

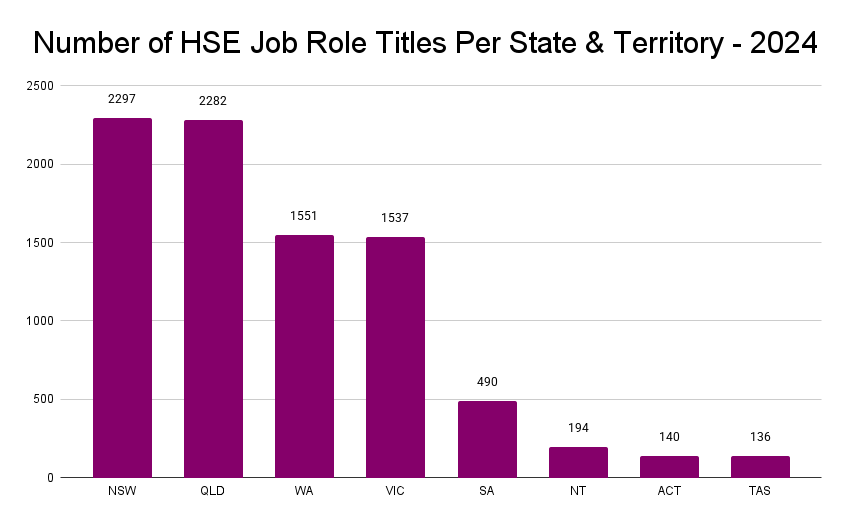

Where were the jobs?

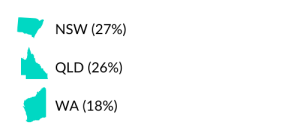

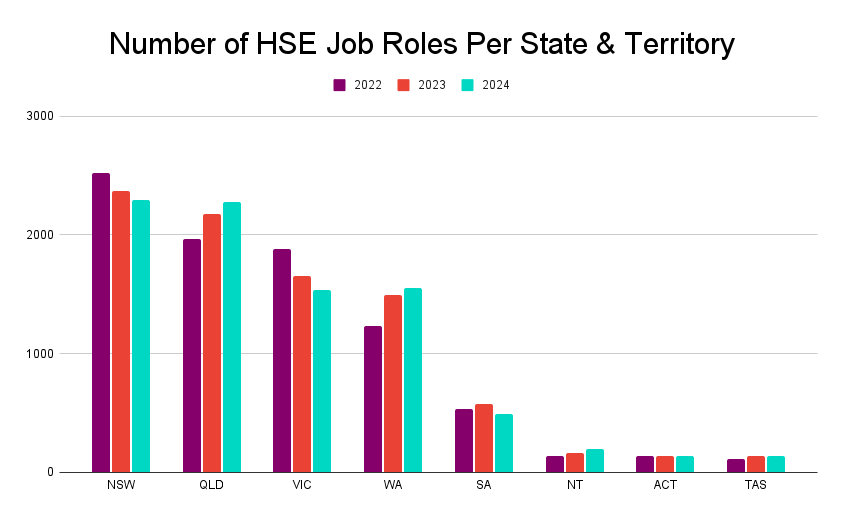

The majority of health and safety roles were advertised in

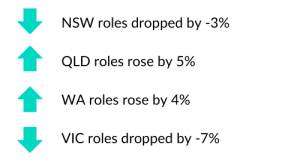

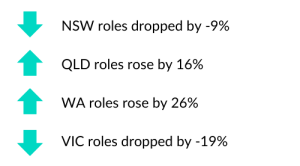

Compared to 2023,

Compared to 2022,

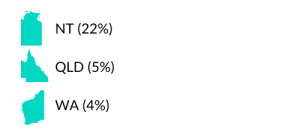

The most significant growth in roles from 2023 to 2024 was seen in;

Industries hiring the most HSE professionals in these three States were Construction, Mining, Government and Industrial Services.

Summarising;

Northern Territory: The Northern Territory (NT) economy is characterised by abundant natural resources, a large public sector and a significant defence force presence. In 2023-24, their economy grew by 4.6%, and employment increased by 1.7%. (Source: https://nteconomy.nt.gov.au/)

Western Australia’s domestic economy grew more than twice the pace of the rest of the country in 2023-24, increasing by 5.3%, compared to 2.4% growth nationally. WA’s unemployment rate is also currently the lowest of all states/territories (Source: WA.gov.au).

Queensland continues to see strong economic growth (3%) due to a rebound in exports (coal, LNG, metals, and beef) combined with public infrastructure spending, continued population growth, a strong labour market, and preparations for the upcoming 2032 Olympics (Source: Qld Budget).

And at What Level?

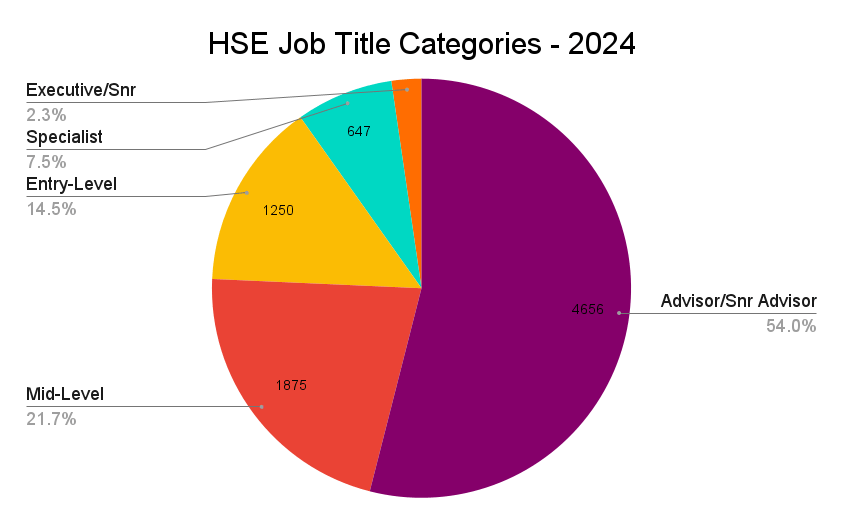

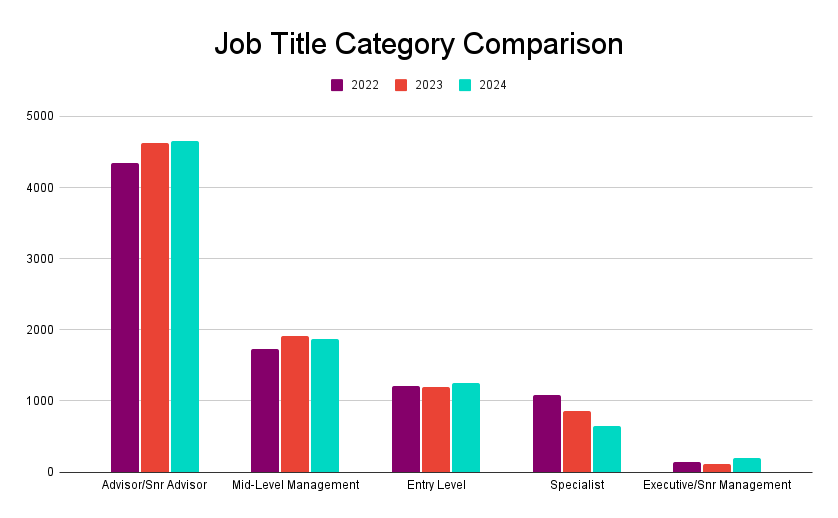

Unsurprisingly, in 2024, the majority of vacancies advertised were allocated to Advisor/Snr Advisor/Business Partner/Consultant level (54% of vacancies).

- Following behind were vacancies targeting mid-level managers (22%) and Entry Level professionals (14%).

- Specialist roles (e.g. workers’ compensation, injury management, systems, etc.) were steady for their market portion.

- Compared to 2023, Advisor/Snr Advisor/Business Partner/Consultant only grew marginally by less than 1%.

- Mid-level Management vacancies dropped by 2%, whereas Specialist roles saw a significant drop of -25%.

- Executive/Snr Management roles grew by 72% compared to 2023, indicating a mix of resignations, retirements and newly created positions. The cost-cutting restructuring of previous periods, where many strategic executive-level managers were replaced with operational managers, flipped across many industries.

Compared to 2022, there were increases for all job titles except for Specialist roles, which dropped by -40%.

- Advisor/Snr Advisor roles rose by 7%

- Mid-Level Management roles rose by 8%

- Entry-Level rose by 4% and

- Executive/Snr Management rose by 40%

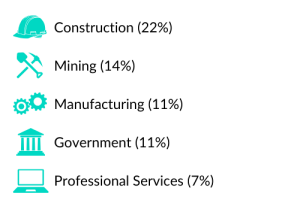

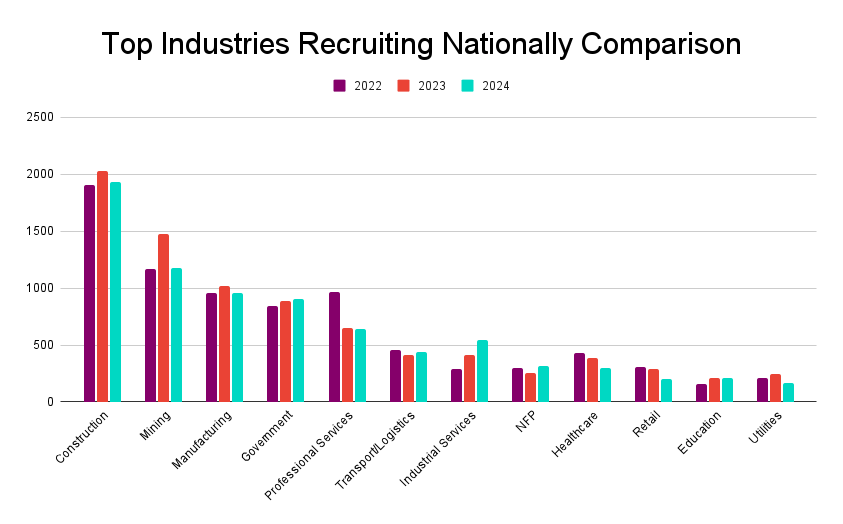

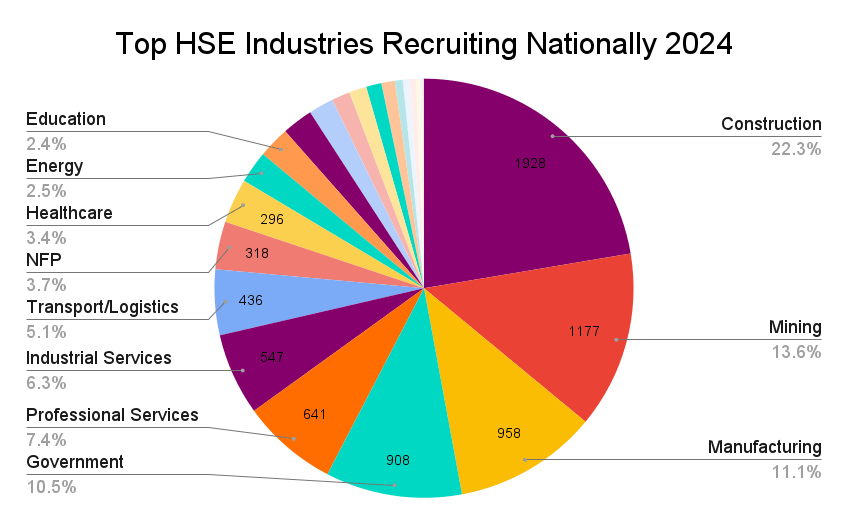

Construction continued its dominance

Just like in 2022 and 2023, construction continued to dominate as the number one employer of health and safety professionals across most States in 2024, except WA, where mining led and ACT, where Government led.

The breakdown went like this;

Compared to 2023, Industrial Services (31%), NFP (25%), Transport/Logistics (5%) and Government (2%) saw the largest increases nationally.

Out of the top 12 industries, compared to 2022, Industrial Services (87%), Education (32%) and Government (8%) saw the largest increases nationally,

Our Key Observations

Reflecting on 2024, it was less of a ‘candidate-led’ market than the previous three years. Employers were starting to experience more candidate flow and shortlists became more competitive.

Our top three key observations from the year include:

Hybrid work: Many businesses began requesting their employees to return to the office 80-100% of the week.

Wages: With the higher-risk industries paying handsomely, there was an imbalance, at times a significant one, when candidates in these industries put themselves back in the general market.

Psychological Safety / Wellbeing: Businesses were nervous about their exposure level, and many were undecided about whether psychological safety and wellbeing belong in P&C or HSE.

What Can We Expect in 2025?

According to Deloitte, Australia’s economy seems to be recovering, with a strong labour market, decreasing inflation, tax cuts, rising real wages, and anticipated interest rate reductions, leading to a more positive outlook in 2025.

We are likewise optimistic that 2025 will be another successful year for HSE professionals and predict that the three key areas posing challenges for safety leaders will be:

Mental health: Physical safety is no longer the sole focus. We envisage a greater demand for candidates with deep exposure to mitigating psychological safety risks. Conversely, it’s a great opportunity for health and safety professionals to up-skill and evolve. We anticipate that many organisations will be reviewing their teams to ensure that they have the right skill-sets in this area.

Technology: Automation and AI are causing significant changes. It’s not just Chat GPT writing policies and procedures, it’s human tracking devices and sensors measuring manual handling risks and increased automation on factory floors. One risk identified by the Centre of Work Health and Safety, is that many businesses introducing AI to their operations don’t understand the limitations and potential work health and safety impacts such technologies can carry with them. This, in itself, causes challenge for the profession.

People & Culture or Safety? We anticipate the continuance of blurred lines between what sits with HR and what sits with Safety. Both functions need to re-set and look at who does what. This should be embraced as a positive because both areas have people at heart, however it could see some senior safety leaders reporting into P&C rather than being at peer level.

Final Word

We’ll keep an eye on the market and share what we find throughout 2025, but we’d love to hear from you.

We’re here to help you with your job search or to assist in recruiting talent for your team.

Celebrating 10 years this year, we’re appreciated for our real-time market data and accessing the talent that organisations can’t meet. But what are we really proud of? Candidates trust us—they know we only recruit for organisations we would be proud to work for.

Looking for your HSE unicorn or for your next role?

For more HSE recruitment tips:

- Follow HOK Talent Solutions on LinkedIn

- Interview Tips & Tricks

- The New Paradigm: Shifting from ‘Culture Fit’ to ‘Culture Add’ Hiring

- How Your CV Can Land You the Top Job

No Comments